FUNDING Societies, the largest SME digital financing platform in Malaysia and South-East Asia, has expanded its financing offerings for the local micro, small and medium enterprises (MSMEs). The syariah-compliant trade financing solutions based on commodity murabahah (tawarruq) is for creditworthy and… Source link

Read More »Malaysia, Japan seek to deepen cooperation in aircraft industry

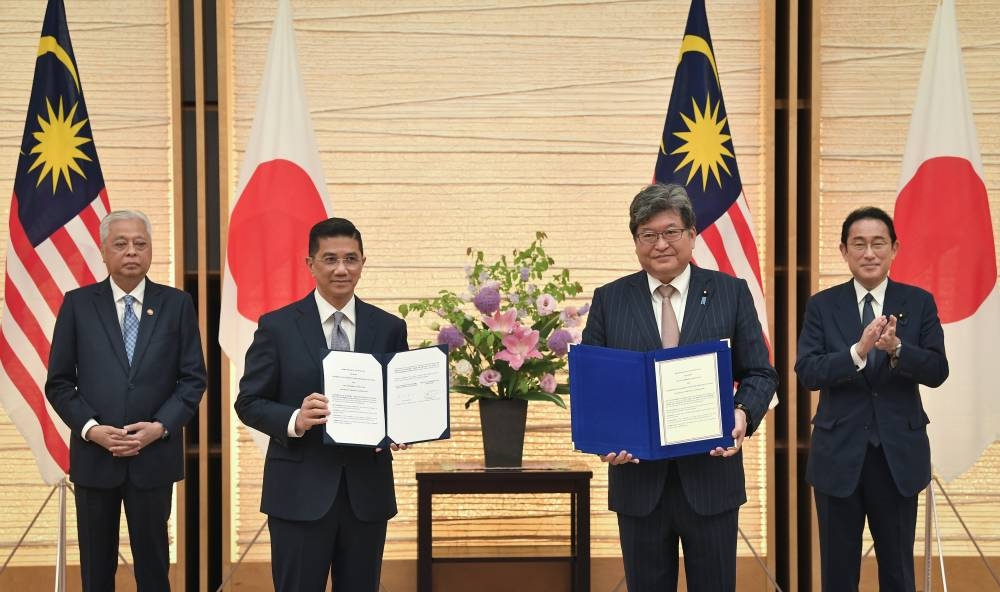

Senior Minister and Miti Minister Datuk Seri Mohamed Azmin Ali exchanged the MoC with Japan’s Economy, Trade and Industry Minister Koichi Hagiuda in a ceremony in Tokyo May 27, 2022. — Bernama pic Friday, 27 May 2022 8:40 PM MYT KUALA LUMPUR, May 27 — Malaysia is strengthening its cooperation with Japan through the establishment of a framework on creating a sustainable supply… Source link

Read More »SME Association: Foreign investors’ renewed confidence in Malaysia to benefit SMEs

A view of the Kuala Lumpur skyline January 10, 2018. The KL Tower can be seen in the centre, with KLCC on the right and the Exchange 106 skyscraper, which is still under construction, on the left. — Bernama pic Thursday, 26 May 2022 9:01 PM MYT KUALA LUMPUR, May 26 — The International Trade and Industry Ministry’s (Miti) success in attracting new investments through various… Source link

Read More »Funding Societies expands finance offerings for micro SMEs

Partners with Masryef Advisory, a Shariah advisor to ensure compliance Shariah-compliant trade financing based on Commodity Murabahah Funding Societies, the SME digital financing platform in Malaysia and Southeast Asia, introduced its Shariah-compliant trade financing solutions based on Commodity Murabahah (Tawarruq) for creditworthy and underserved Malaysian micro, small, and medium… Source link

Read More »Singapore’s Funding Societies expands financing offerings for MSMEs via Islamic FinTech facilities

Funding Societies, the Singapore-based small and medium-sized enterprise (SME) digital financing platform, on Wednesday introduced its Shariah-compliant trade financing solutions based on Commodity Murabahah (Tawarruq) for creditworthy and underserved Malaysian micro, small, and medium enterprises (MSMEs) seeking to grow their business or expand their working capital as the country… Source link

Read More »Special Report: ‘Banks risk losing SMEs to alternative lenders’

BANKS need to step up their digital game or risk losing small and medium enterprises (SMEs) to alternative lenders, according to US-based data analytics firm FICO. Its recent survey of SMEs in Asia-Pacific found that 44% of respondents in Malaysia were interested in taking up new borrowing products this year, while 43% were considering alternative or non-traditional lenders. Interestingly, the… Source link

Read More »Flood insurance lacks demand in a market where capacity is sufficient

Insured losses arising from the Great Malaysian Flood in December 2021 could amount to approximately MYR1.5bn ($342m) to MYR2bn, according to an assessment by Malaysia Reinsurance, says Mr Zainudin Ishak, president & CEO of the reinsurer. The insured losses could be roughly 20%–30% of the economic loss of MYR 5.3bn to MYR6.5 bn estimated by the Department of… Source link

Read More »OPR hike aims to ensure sustainable growth — SME Bank

KUALA LUMPUR (May 17): Bank Negara Malaysia’s (BNM) move to raise the Overnight Policy Rate (OPR) to 2.0% aims to ensure that the monetary policy remains accommodative to support sustainable economic growth, while enabling the economy to withstand external shocks, said SME Bank. In a statement, group chief executive officer Dr Aria Putera Ismail said as the domestic economy is growing… Source link

Read More »COVID-19, SMEs, and SmartBusiness

This post is sponsored by UOB Malaysia. In recent years because of the business environment created in the wake of the pandemic we have seen the advent of new technological advances, which businesses have adopted to ensure their businesses stay afloat. Due to the new normal of working from home, small businesses have had to invest in new digital tools to digitise what were… Source link

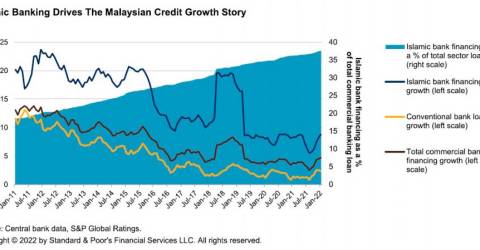

Read More »S&P anticipates Malaysia’s GDP growth this year due to Islamic banking sector

PETALING JAYA: S&P Global Ratings has forecast Malaysian Islamic banks to grow at a compound annual growth rate of 6-8% over the five-year period of 2022-2026, which means local Islamic banks could account for close to 45% of the overall commercial banking loan book by the end of 2026, up from 37.5% in January 2022. “That said, short-term headwinds may hinder the recovery in loan growth…. Source link

Read More »